Financial Modeling Using Quantum Computing: Where to Read Online | EPUB

Published: 16 Jun 2025

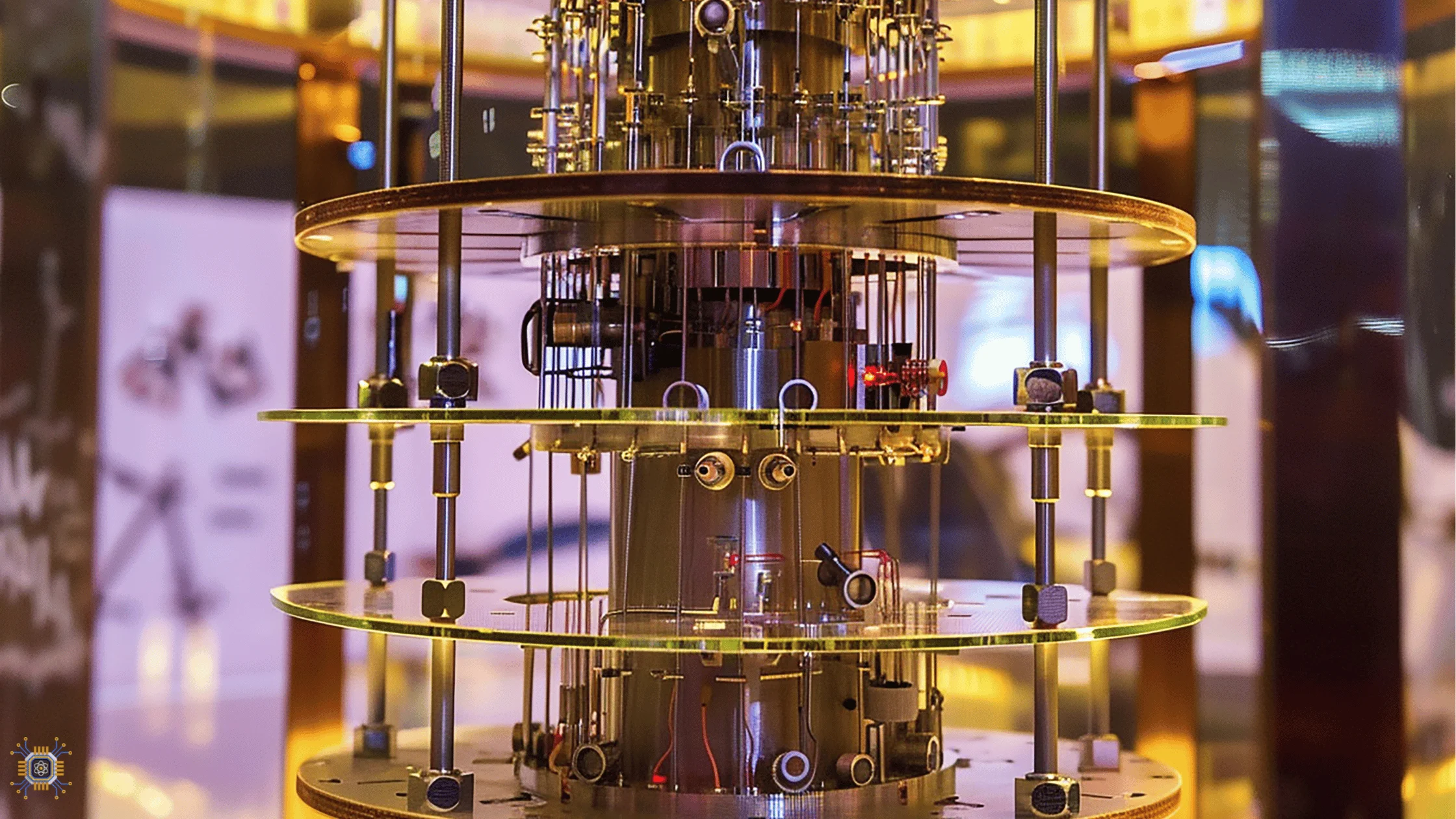

Financial modeling is evolving because of quantum computing. Risk assessment, portfolio optimization, and predictive analytics are some of the types of financial models that are being transformed.

If you want to read about these types of models and how they’re using quantum computing to overcome speed and scale limitations of conventional computers, several online resources offer good overviews.

Available Online Resources

Below are 10 platforms from which you can obtain books, articles, and research papers pertaining to quantum computing and financial modeling.

- GitHub Repository – The GitHub repository for Financial Modeling Using Quantum Computing has code samples and real-world implementations.

- O’Reilly Media has the book Financial Modeling Using Quantum Computing available, and they are offering a free 10-day trial of the book.

- The book can be found on IEEE Xplore, opening up a world of insight concerning applications of quantum machine learning in finance.

- Search for research papers about financial modeling using quantum computing on Google Scholar.

- ArXiv – Locate research papers in the field of open-access quantum computing, available on ArXiv.

- SpringerLink – Discover scholarly volumes and articles relating to the financial modeling of quantum computing on SpringerLink.

- ResearchGate: Connect with scientists and find portals to papers about quantum finance on ResearchGate.

- Massachusetts Institute of Technology OpenCourseWare – Understand the principles of quantum computing by taking free online courses via the OpenCourseWare platform from the Massachusetts Institute of Technology.

- The publication of the book Financial Modeling Using Quantum Computing was carried out by Packt Publishing.

- Stack Exchange for Quantum Computing – Discuss quantum finance issues and find answers with this community of experts. You will most likely not get better help anywhere else.

Key Topics Covered

These resources usually investigate:

- Comprehending quantum computing frameworks. Their functions and forms in financial modeling.

- Optimization of the Portfolio: Using algorithms of quantum to augment strategies of allocation of assets.

- Financial risk assessments can be improved through the application of quantum-enhanced simulations, which are powerful tools for risk management.

- Leverage quantum algorithms in for finance predictive analytics of machine learning.

- Qiskit and Pennylane Implemented: Real-world applications of quantum computing frameworks in the finance sector.

Practical Applications

Different financial areas are doing tests with quantum computing:

- Algorithmic Trading: Quantum algorithms enhance trading tactics by parsing multitudes of datasets with lightning speed. This is combo of these two stuff makes algo trading more reliable.

- Credit Scoring: Models enhanced with quantum computing take credit risk evaluations to a new level.

- Detecting Fraud: Anomaly detection, which is kind of like a series of profiles for normal behavior, is used throughout the financial industry. Because quantum computers are so much faster and better at solving problems with a lot of variables than classical computers, they are used to find anomalies in the profiles that might indicate fraud.

Conclusion

If you want to gain a deeper understanding of financial modeling with quantum computing, check out these online resources. They’re a great place to start, whether you’re a finance practitioner, researcher, or student, when it comes to grasping the real-world implications of using quantum computing for financial decision-making.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks